Title 14, §6038: Treatment of security deposit

Category : Bookkeeping

Content

Also, if the bank charges a monthly maintenance fee for the account, landlords must deposit enough funds in the account to ensure that the bank fees do not reduce the tenant security deposit amount. Tenant security deposits are normally refundable to the tenant at the end of the lease, unless the lease agreement states otherwise. If you keep part or all of the security deposit, https://kelleysbookkeeping.com/ that amount should be reported as rental income on the date it was withheld. The amount withheld, once used to pay for the repairs or other damage caused by the tenant, should then be reported as an expense in your Schedule E under the appropriate category. A common question about security deposit accounting is whether a security deposit is considered rental income.

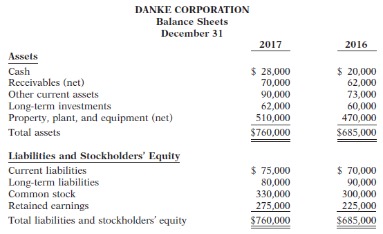

The total value of assets stays the same, so the balance sheet remains balanced. When the deposit is a liability, the company takes $1,000 out of cash to give back to the customer and erases the $1,000 liability. Assets and liabilities have each decreased by $1,000, so the sheet is still balanced. Since the security deposit is refundable the tenant that paid the security deposit will report the amount as an asset. If the tenant intends to occupy the rental unit for more than one year, the security deposit should be reported as a long-term asset under the balance sheet classification “Other assets”. When leasing a property, companies must meet several conditions specified in the lease agreement by the landlord.

Company

Of course, be sure not to double count the rent in your tenant’s final month. Successful landlords must have a system in place to accurately Is A Security Deposit An Asset? account for their security deposits. Following are best practices to help you manage your security deposits and maintain compliance.

The accounting treatment will be the reverse of that done by the lessee. Overall, the journal entries for the receipt of the security deposit will be as follows. When the lessee pays this amount, they are basically giving it to the lessor for a future refund.

Keep security deposits in a separate bank account

The statement includes deposits, charges, withdrawals, as well as the beginning and ending balance for the period. You enter the security deposit to create a record in the Security Deposit Master table , which you use for tracking and reporting information about security deposits. The security deposit will reduce from the balance sheet and move to revenue on the income statement. The lessor only reverses the security deposit when the contract finishes.

- In this article, we’ll share security deposit accounting tips for real estate investors, as well as how to account for security deposit returns.

- When the deposit is a liability, the company takes $1,000 out of cash to give back to the customer and erases the $1,000 liability.

- Additionally, there is always the risk that the financial institution holding the deposit could default and cause losses to investors.

- Therefore, the lessee cannot enter a lease agreement without payment.

- It is a security deposit which will be repaid at the end of the lease term and doesn’t carry any interest cost.

Moreover, it is also the cash to settle with property damage caused by tenants during leasing. They will keep the deposit as compensation to repair the property at the end of rental contract. Security deposit entails the finances rendered to a leaser of a given property by the lessee when they show interest to utilize the property under rent terms. The accounting for security deposit will differ from lessors to lessees. In both circumstances, this deposit will represent a financial instrument.

What is the Accounting for Security Deposit?

Deposits as Liabilities When a company collects a security deposit from a customer, the amount appears on its balance sheet as a liability. If you do have to retain some or all of a tenant’s security deposit, it becomes income at that point in time. In most circumstances, however, the lessor will charge some amount for repairs. The journal entries for the refund of a security deposit are as follows, assuming damages exist. To illustrate, recall that when the Smith Family moved into their rental home in Texas they paid a security deposit of $2,000. When the Smiths moved out, they accidentally broke a window, and the quote received by the landlord to repair the broken glass was $250.

DrSecurity depositCrCash or bankWhen the landlord refunds the security deposit, the tenant must reverse the above entry as below. Companies often operate from a physical location, which includes land and a building. In some cases, companies may also have manufacturing plants or factories. However, some may also rent or lease property from other parties, known as landlords. It is important to remember that investments in fixed deposits are not without risk.

AccountDebitCreditCash2,000Security Deposit2,000Security deposit will be present on balance sheet under the liability section until the end of the rental contract. Since the lessee has made this election the rental payments are not amortized / a right to use asset is not recognized and so the rental payments are treated as a rental expense. I have a question related to the treatment of a lease rental security deposit pertaining to the standards IFRS 9 / IFRS 16. Funds held in escrow represents cash that is set aside until predetermined conditions are satisfied. For example, often in an acquisition, part of the purchase price is set aside escrow and is only released if the business achieves certain milestones. The important thing to understand is that funds held in escrow must be classified as…