Interactive Brokers Review 2021: Forex Broker Reviews & Ratings

Category : Forex Trading

Contents:

Interactive Brokers is a brokerage firm that offers a wide range of online trading services. It was founded in 1978 and has its headquarters in Greenwich, Connecticut. The company offers trading in multiple financial instruments, including stocks, options, futures, forex, and bonds. Interactive Brokers is known for its low commissions and fees, advanced trading platforms, and robust trading tools.

You can set a date and time for an order to be transmitted or submit a conditional order that becomes active after specific conditions are met, such as when an existing order executes. Aside from this Interactive Brokers review, we’ve also reviewed the Interactive Advisors’ robo-advisor service. Hans Daniel Jasperson has over a decade of experience in public policy research, with an emphasis on workforce development, education, and economic justice.

As the picture below shows, it can be a little confusing when there are several companies with a similar name or if a company has both common and preferred shares. The Interactive Brokers mobile trading platform boasts a lot of functions and a useful chatbot, but its user interface could be better. As an individual trader or investor, you can choose from many account types. A few of these, such as the IRA account, are available only to US clients. In the case of stock index CFDs, all fees are incorporated into the spreads. When you trade stock CFDs, you pay a volume-tiered commission.

Interactive Brokers Review: Total control for experts & beginners

With Ending Client Equity of USD 373.8 billion and Equity Capital of USD 10.01 billion, Interactive Brokers is a trusted, well-capitalized broker. Interactive Brokers enables customers to trade from a vast selection of global financial markets, from stocks and options to futures and spot forex. This means that losses can be substantial and traders should know the high risks of online trading and consider a demo account first. In regions such as America, Europe and Japan, leverage is heavily restricted. Traders looking for higher leverage should view the best forex broker table. This can include algorithmic traders who often require the highest leverage available.

The Good Money Guide is a UK-based guide to trading, investment and currency accounts. We offer expert reviews, comparison, news, analysis, interviews and guides so you can choose the best provider for your needs. In tune with moving with the times, Interactive Brokers has also released the IMPACT app to help people investing in ESG and impact sectors, so they can put their money to good. You can see the IMPACT dashboard on desktop, but it also operates as a standalone app that connects directly to your IBKR account and scores your portfolio based on how ethical the stocks you hold in it are. Ratings come from FactSet and Refinitiv, and there is this excellent feature that allows you to swap into more ethical stocks. If you’re in the US, you can also make charitable donations directly on the app.

Interactive Brokers leads the list of the most comprehensive investment platforms. Clients can trade stocks, options, futures, forex, cryptocurrencies, bonds, and funds in 150 markets from a single, integrated account. Interactive Brokers’ Bond Marketplace has a vast universe of over 1 million bonds globally with low, transparent commissions and no mark-up or built in spreads. Interactive Brokers is 1 of the best in the industry for fixed-income securities. Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. IBKR also offers a free mutual fund search tool that can be used to search for and identify funds by a number of categories including fund type, fund family, commissions charged and country of residence.

Want to start trading with your check without waiting for your bank transfer? IBKR offers an instant mobile check deposit that allows you to deposit your paper checks directly to your brokerage account. Just snap a photo, enter the amount on your check, verify that you’re the one making the deposit by completing 2-factor authentication and IBKR will finish the deposit for you. IBKR offers a massive range of options contracts for both the domestic and international markets.

Alternatively, please contact IB Customer Service to receive a copy of the ODD. Before trading, clients must read the relevant risk disclosure statements on our Warnings and Disclosures page. Trading on margin is only for experienced investors with high risk tolerance. For additional information about rates on margin loans, please see Margin Loan Rates. Security futures involve a high degree of risk and are not suitable for all investors.

Interactive Brokers is highly recommended for those seeking a broker with all-round great services at low fees. It has an unrivaled selection of all asset types from exchanges across the globe. Its trading platforms offer great functionality and advanced research. However, the size and complexity of IBKR’s services also lead to some drawbacks.

Interactive Brokers offers a number of screeners and tools traders can use to find better investments for their portfolios. IBKR also offers some of the lowest margin rates on both Lite and Pro accounts. Margin rates range from 0.75% APR to 2.55% APR, depending on your trading volume and the type of account you have. Professional tools at IBKR allow licensed advisors to manage custodial accounts, improve their business strategies and help their clients make money.

What are the fees and commissions?

One place where they stood out in particular was the wide range of international investment opportunities as Interactive Brokers gives access to markets in 33 countries. Their other account fees are also minimal, such as a very low $10 fee for outgoing wires. There also may be inactivity fees for low-balance accounts that remain dormant for too long. They do not charge many of the other common fees like for security reorganization or mutual fund redemption that you may see at other brokers. That said, beginners could find Interactive Brokers a little overwhelming to use, especially if they venture onto the IB Trader Workstation.

Last but not least, the GlobalTrader app is a boon for international investors who are looking for mobile access to markets. New features and products are regularly added to the IBKR trading platforms, with additional funds regularly added to the massive number of U.S. and international mutual funds. IBKR is a superb platform for advanced and professional traders looking for a massive selection of order types to execute sophisticated trading strategies across assets and markets.

Account opening is long and tedious, platforms may be too complex for beginner traders, and customer service can be busy. For a more streamlined experience, check out the IBKR GlobalTrader app to trade stocks, options and crypto at similar fees. In addition to competitive spreads and low commission-based pricing for forex, Interactive Brokers provides more third-party research than any other broker. Quizzes and tests benchmark student progress against learning objectives. Course offerings include introductions to asset classes such as options, futures, forex, international trading, bonds, and how to use margin. Interactive Brokers stands out for its trading platforms, which include its flagship desktop software and web trading app – both of which provide access to advanced trading tools and global financial markets .

IBKR’s proprietary Tax Optimizer tool lets you set a default matching method, which you can override for specific symbols if desired. To help you maximize tax efficiency, the Tax Optimizer provides a “what-if” capability, which provides a preview of P&L for each of the matching methods. Dozens of real-time news sources are available on all platforms. We found this one of the best options platforms, but too complex for the average retail trader. That said, IBKR has upped its game with more education and assistance in navigating the platform. The fee is 0.18% up to $100,000 in crypto, 0.15% for 100,000 to $1 million, and 0.12% for monthly trade values above that.

Interactive Brokers’ trading platform is very easy to customize. Where Interactive Brokers really starts to rack up the user experience points is when experienced brokers are using the feature-rich, customizable interactive brokers forex review Trader Workstation. They were already considered to be one of the lower-cost brokers out there despite the inactivity fee but with it’s reduction it’s going to be interesting to see how their competitors react.

You’re our first priority.Every time.

We research other trading costs, such as inactivity or custody fees, minimum deposit requirements, VIP rebates and/or discounts, and an exhaustive list of other important fee-based data points. Our research team, led by Steven Hatazkis, conducts thorough testing on a range of features, including each broker’s individual products, services, and tools . We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. Regardless of your trading budget, you’ll need to choose a dependable method for depositing and withdrawing funds for your live trading account.

- Do-it-yourself structure and trading platform options work well for advanced, high volume traders.

- After you selected the ownership of your account, you can choose between Cash, Portfolio Margin, or Reg T Margin accounts.

- Answer a couple of questions, based on which Interactive Advisors will compile a portfolio that is automatically rebalanced from time to time.

- The table below shows the range of markets including Stocks, Options, Futures and even Bonds.

- Beware – if you use IBKR the account transfer from your old brokerage firm will be on hold for 30days.

Like most forex brokers, IBKR charges a small percentage of your trade value in the form of a spread. Interactive Brokers offers traders full access to the U.S. stock market on both its Pro and Lite platforms. You can even access stocks listed https://broker-review.org/ on European and Asian stock exchanges to buy and sell foreign securities. Though IBKR’s desktop platform may be a dream to professional traders or those with market experience, there’s a steep learning curve for new traders to conquer.

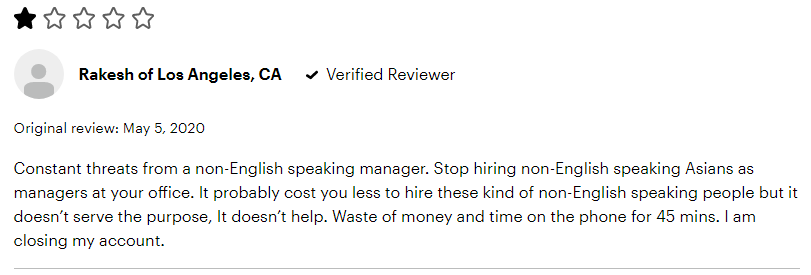

Reviews

You can see a list of brokers that offer financial spread betting here. This is an in depth platform with comprehensive risk analysis and global technical research news to help serious traders do some serious business. It requires a software download – this is not an online-only platform.

Interactive Brokers also offers a complete and comprehensive FAQ section, which can answer most of your on-demand questions. Interactive Brokers offers a unique Ibot chat request feature that can instantly respond to thousands of service inquiries. You can also sign up for Interactive Brokers’ daily trading newsletter from its blog and receive insights sent directly to your inbox.

The enviroment is relly profetional

The fee for subsequent withdrawals after the first free one depends on the currency and the method used for withdrawal. Similar to deposits, you can only use bank wire for outgoing transfers. Also, as of early 2020, Interactive Brokers introduced direct debit card depositsas part of their Integrated Investment Management account. However, deposit options are limited, as neither credit/debit cards nor electronic wallets can be used. See the table below for interest rates for some selected currencies, or check out IB’s relevant page for the latest rates and more details. Options fees at Interactive Brokers are generally low/average.